- Jan 09, 2026

US Interest in Venezuela’s Oil Sector Claimed, but Investment Remains Uncertain

- Jan 07, 2026

- International

International Desk: PNN

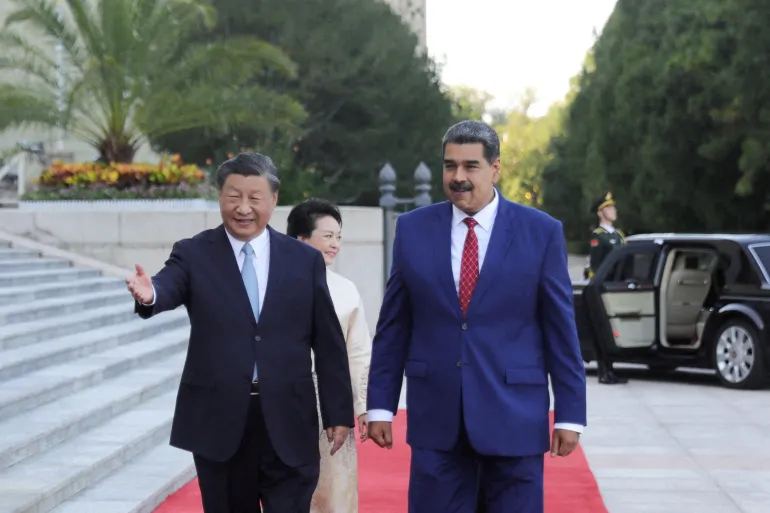

Following the alleged takeover of Venezuela by a US special force from President Nicolas Maduro, former US President Donald Trump has promised investments in the country’s underdeveloped oil fields.

On January 3, during a press conference at Mar-a-Lago, Trump said, “Our major US oil companies will enter the country, spend billions to rebuild the degraded oil infrastructure, and begin generating revenue for the country.”

The next day, on January 4, during a conversation with journalists aboard Air Force One, he reiterated, “Oil companies are ready. They will make major investments in rebuilding the infrastructure.”

However, the actual feasibility of these investments remains doubtful. Trump’s statement did not mention any specific company. Marco Rubio, US Secretary of State, said that “significant interest is expected from Western companies,” but provided no concrete details.

PolitiFact reported that the White House has been in talks with several oil companies, though no names were disclosed. White House spokesperson Taylor Rogers said, “All our oil companies are ready to make major investments in Venezuela.”

The American Petroleum Institute, representing the US oil industry, warned that companies make investment decisions worldwide based on stability, law and order, market conditions, and long-term operations.

Some experts say the potential for major investment in Venezuela’s oil sector is limited. Despite large oil reserves, the high initial cost of infrastructure development, political instability, and low current oil prices reduce profitability. Professor Hugh Deigle from the University of Texas said, “For any US-based company, there is no solid foundation for profitable long-term investment in Venezuela.”

Other analysts note that US companies might be interested to diversify investments, but high initial costs, political uncertainty, and low oil prices make large profits unlikely. Additionally, with the growth of electric vehicles, future oil demand may decline, reducing long-term return prospects.

Experts agree that US oil companies would only invest in Venezuela by accepting major political and financial risks. At present, it is unclear how feasible Trump’s promised investments are.